In a surprising new policy, the Enugu State Internal Revenue Service has announced that owners of deceased individuals will now be subject to a tax if the body is not buried within 24 hours.

The regulation stipulates a daily fee of 40 Naira for every day the body remains unburied.

This unprecedented move, described as the “Bill for the Living and Bill for the Dead,” has sparked widespread criticism and concern among residents.

Many are questioning the ethical implications of taxing the deceased and the families grieving their loss.

Critics argue that this tax adds an unnecessary financial burden on families during an already difficult time, while supporters claim it is a step toward ensuring proper burial practices are followed in the state.

As the policy takes effect, it remains to be seen how the public will respond and whether there will be any changes in the wake of this controversial decision.

DEAD BODIES TO PAY TAXES IN ENUGU STATE as Enugu State Government TAKES its TAX COLLECTION TO CORPSES IN THE MORTUARY…..

The new implication mortuary tax read….

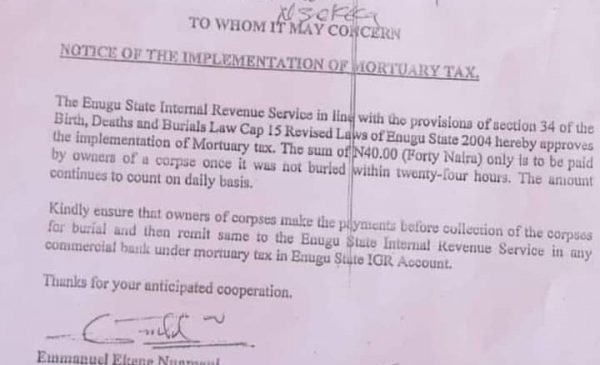

“ALL MORTUARY ATTENDANT TO WHOM IT MAY CONCERN

The Enugu State Internal Revenue Service in line with the provisions of section 34 of the Birth, Deaths and Burials Law Cap 15 Revised Laws of Enugu State 2004 hereby approves the implementation of Mortuary tax. The sum of N40.00 (Forty Naira) only is to be paid by owners of a corpse once it was not buried within twenty-four hours. The amount continues to count on a daily basis.

Kindly ensure that owners of corpses make the payments before collection of the corpses for burial and then remit same to the Enugu State Internal Revenue Service in any commercial bank under mortuary tax in Enugu State IGR Account.

Thanks for your anticipated cooperation.

Emmanuel Eltene Nnamani Executive Chairman.