Ahead of the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) meeting this week, the naira continued its strong run against the United States dollar at the weekend, underscoring the resolve of the apex bank to achieve convergence of rates between the interbank and Bureau de Change segments.

The dollar along with other convertible currencies at the end of last week crashed against the naira, as the Nigerian currency gained at the parallel market, exchanging at between N376 and N380 to $1 compared to the rate of N390 and N385 at which it had exchanged for about a week.

However, in other segments of the market – Deposit Money Banks (DMBs) and Travelex, the naira did not exchange above the N362 threshold.

Exchanging views with reporters, experts expressed hope that the rebounding Naira would boost the Nigerian economy and reposition it for even greater gains. They, however, the apex Bank to keep its pledge of sustaining forex liquidity.

Meanwhile, a source at the CBN said that the bank remained committed to ensuring a convergence of forex rates and that the recent gains recorded by the bank are sustained.

According to the CBN source, the CBN would continue to make necessary interventions to ensure the stability of the naira.

The source further reiterated that the windows established by the CBN for Small and Medium Enterprises (SMEs) as well as for investors and exporters continued to yield the desired results by providing access to forex and easing pressure on the market.

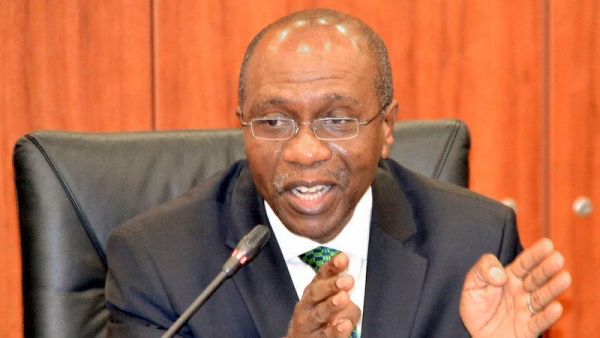

Corroborating the source, the Acting Director of Corporate Communications at the CBN, Isaac Okorafor, reiterated the bank’s commitment to ensure that there is enough supply of forex to genuine customers to achieve the goal of forex rates convergence.

It will be recalled that at the last MPC meeting of the bank in March, the Governor, Godwin Emefiele, stressed that one of the objectives of the bank was to achieve a convergence of the rates in the various segments of the market.

As the MPC meets on Monday, May 22 and Tuesday, May 23, 2017, watchers are expectant to see what new measures and rates the MPC plans to unfold in its goal of ensuring stability in the financial system.

Source: News Express